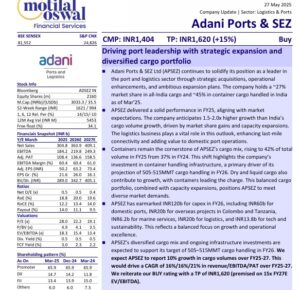

🟦 Adani Ports & SEZ (APSEZ) Share Price has shown promising growth potential, as indicated by the recent Investment Summary (BUY) by Motilal Oswal Research on May 27, 2025. This assessment underscores the favorable outlook for investors considering APSEZ. Adani Ports & SEZ (APSEZ) Share Price is demonstrating substantial growth potential as per the latest Investment Summary (BUY) by Motilal Oswal Research on May 27, 2025. This evaluation indicates a positive forecast for investors interested in APSEZ. The recent recommendation further solidifies the optimistic stance towards APSEZ. – Investment Summary (BUY)

(As per Motilal Oswal Research – Dated May 27, 2025)

📌 Investment Rating: ✅ BUY

➡️ Expected Return: ≥ 15% in 12 months

📈 Target Price (TP): ₹1,620

📉 Current Market Price (CMP): ₹1,404

🔼 Expected Upside: +15.3%

📊 Valuation Basis:

→ 15x FY27E EV/EBITDA

🔑 Key Drivers for BUY Rating:

-

Strong FY25 Performance ✅

-

Cargo Volume Growth 🚢

→ 10% CAGR over FY25–27

→ Growth 1.5x–2x of India’s cargo volume -

Port Market Leadership 📦

→ 27% share in all-India cargo

→ 45% share in container cargo (Mar’25) -

Diversified Cargo Portfolio

→ Containers: 42% in FY25 (vs. 37% in FY24)

→ Balanced dry + liquid cargo mix -

Capex Plan: ₹120 Billion in FY26 🏗️

Area Allocation Domestic Ports ₹60b Overseas (Colombo, Tanzania) ₹20b Logistics ₹20b Marine Services ₹6.2b Tech & Sustainability ₹13.8b

-

Strategic Port Expansion 🌐

→ India: Gopalpur, Vizhinjam (0.1m TEUs/month)

→ Global: CWIT (Sri Lanka), Dar es Salaam (Tanzania), Haifa (Israel), Abbot Point (Australia) -

Integrated Logistics Play 🚚

→ Block trains, MMLPs, warehouses, agri silos, trucks -

Marine Business Upscaling ⚓

→ Plan to 3x size in 2 years -

Financial Outlook FY25–27 📈

Metric CAGR (%) Revenue 16% EBITDA 16% PAT 21% → EBITDA margin: ~60%

→ Net D/E: Improves from 0.6x → 0.4x

→ Strong RoE & RoCE improvement