TD Power Systems Ltd :

| Metric | Value |

|---|---|

| Market Cap | ₹ 7,601 Cr. |

| Current Price | ₹ 487 |

| 52W High / Low | ₹ 510 / ₹ 281 |

| Stock P/E | 43.5 |

| Book Value | ₹ 55.1 |

| Dividend Yield | 0.23% |

| ROCE | 29.8% |

| ROE | 22.3% |

| Face Value | ₹ 2.00 |

| Industry P/E | 41.6 |

| EPS (TTM) | ₹ 11.2 |

| PEG Ratio | 0.78 |

| Promoter Holding | 33.2% |

| Change in FII Holding | +1.33% |

| Change in DII Holding | -1.99% |

| Profit CAGR (5 Years) | 55.6% |

| Price to Book Value | 8.83 |

| Enterprise Value | ₹ 7,414 Cr. |

| Free Cash Flow (3 Yrs) | ₹ 96.2 Cr. |

| Debt | ₹ 12.2 Cr. |

| Gross Block | ₹ 480 Cr. |

| CWIP | ₹ 16.6 Cr. |

| Leverage Ratio | 1.40 |

| Dividend Payout | 11.2% |

| Debt to Profit | 0.07 |

| Down from 52W High | 4.58% |

TD Power Systems Limited (TDPS) has demonstrated strong financial performance, particularly in the fiscal year ended March 31, 2025 (FY25) and the fourth quarter of FY25 (Q4 FY25).The company achieved its highest ever revenue, EBIDTA, and Profit After Tax (PAT) in FY25

FY25 Financial Highlights (Consolidated):

Total Revenue/Income: Increased significantly to ₹12,911 Million in FY25 from ₹10,052 Million in FY24, representing a 28% increase year-over-year (YoY)

EBIDTA: Rose to ₹2,431 Million in FY25 compared to ₹1,721 Million in FY24, a substantial 41% YoY growth.The EBIDTA Margin improved to 18.8% in FY25, up from 17.1% in FY24, an increase of 1.7 percentage points (bps).

Profit After Tax (PAT): Reached ₹1,734 Million in FY25, a remarkable 50% increase from ₹1,156 Million in FY24. The PAT Margin saw a similar positive trend, increasing to 13.4% in FY25 from 11.5% in FY24, a gain of 1.9 bps.

Gross Profit: Stood at ₹4,602 Million in FY25, up 31% YoY from ₹3,500 Million in FY24. The Gross Profit Margin slightly improved to 35.6% in FY25 from 34.8% in FY24, an increase of 0.8 bps.

Other Operational Income: howed a significant increase, reaching ₹123.19 Million in FY25 compared to ₹46.97 Million in FY24. Interest income was ₹113.31 Million in FY25 compared to ₹115.09 Million in FY24

Q4 FY25 Performance (Consolidated):

Total Income: Was ₹3,564 Million, a 34% increase YoY from Q4 FY24.

EBIDTA: Was ₹737 Million, showing a substantial 69% increase YoY.The EBIDTA Margin was 20.7%, a strong improvement of 4.3 bps YoY.

PAT: Amounted to ₹527 Million, a 93% increase YoY. The PAT Margin was 14.8%, up by 4.5 bps YoY.

Gross Profit: Was ₹1,332 Million, up 37% YoY. The Gross Profit Margin was 37.4%, a 0.7 bps increase YoY.

Other Operational Income saw a sharp jump to ₹82.25 Million in Q4 FY25 compared to ₹16.71 Million in Q4 FY24

Order Inflow and Order Book:

TDPS achieved its highest ever Order Inflow in FY25 at ₹14,783 Million, a 41% growth YoY.

Q4 FY25 also saw the highest ever quarterly Order Inflow since inception, reaching ₹4,134 Million, a 43% increase YoY.

In FY25, 67% of the order inflow came from Exports, amounting to ₹9,852 Million, a 67% growth YoY

Credit : AlphaStreet India

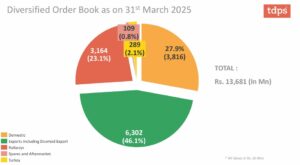

The Order Book as of March 31, 2025, stood at ₹13,681 Million.The order book is diversified, with Exports including Deemed Exports making up the largest share at 46.1%, followed by Domestic (27.9%), Railways (23.1%), and Spares/Aftermarket (2.8%)

Management comentry a strong order book driven primarily by exports, particularly in the gas turbine, engine, motor, and hydro businesses, with significant opportunities identified in data centers, AI server farms, and grid stabilization. The company also provides guidance for future revenue and order inflow, outlines plans for a new design center in the U.K., and addresses questions regarding margins, working capital, domestic market trends, and expansion into new market segments.